Global Nuclear Fuel Cycle: Processes, Market and 2024 U.S. Enrichment Ban

Updated Published Cached

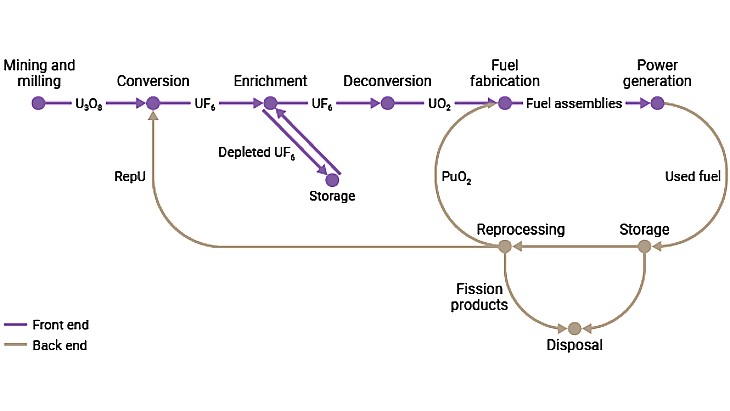

The nuclear fuel cycle turns mined uranium into electricity and ends with waste disposal. The cycle’s front end includes mining, milling, conversion, enrichment and fuel fabrication, while the back end handles spent fuel through storage, reprocessing or disposal, typically after about three years in a reactor [1].

In‑situ recovery dominates uranium mining, with Kazakhstan as the top producer. Uranium is extracted either by open‑pit/underground mining or by dissolving ore in wells (ISR), the latter now most common; Kazakhstan supplies the largest share of global uranium using ISR [1].

Conversion refines yellowcake to UF₆ gas, then centrifuges enrich it to LEU or HALEU for reactors. Conversion turns U₃O₈ into UO₂ and then UF₆; enrichment raises U‑235 from 0.7 % to 3.5‑5 % for low‑enriched uranium or up to 20 % for high‑assay low‑enriched uranium, using gas‑centrifuge technology [1][3].

Uranium is traded on spot and long‑term markets without a formal exchange, with price indices from private firms. Utilities and investors buy physical uranium on a daily‑priced spot market or via 3‑15‑year contracts tied to spot prices; price benchmarks are published by UxC, LLC and Tradetech [1].

Limited conversion and enrichment capacity creates supply bottlenecks, highlighted by the 2024 U.S. LEU import ban. Only a few commercial enrichment firms—Orano, Rosatom, Urenco and China’s CNNC—operate large plants, and U.S. domestic capacity cannot meet demand, prompting a 2024 law prohibiting Russian‑origin low‑enriched uranium imports through 2040 [1].

Fuel fabrication is a specialized, non‑fungible service linked to reactor designs and major vendors. Fabricators, often owned by reactor manufacturers, produce custom fuel assemblies that meet strict regulatory standards; detailed information is provided in the World Nuclear Association’s fuel‑fabrication paper [1][4].

Links

- [1] https://www.world-nuclear-news.org/articles/the-nuclear-fuel-cycle-a-guide

- [2] https://world-nuclear.org/information-library/nuclear-fuel-cycle/introduction/nuclear-fuel-cycle-overview

- [3] https://world-nuclear.org/information-library/nuclear-fuel-cycle/conversion-enrichment-and-fabrication/uranium-enrichment

- [4] http://https://world-nuclear.org/information-library/nuclear-fuel-cycle/conversion-enrichment-and-fabrication/fuel-fabrication

_88592.jpg)