Bank of England Expected to Hold Rate at 3.75% Amid Persistent Inflation

Updated (4 articles)

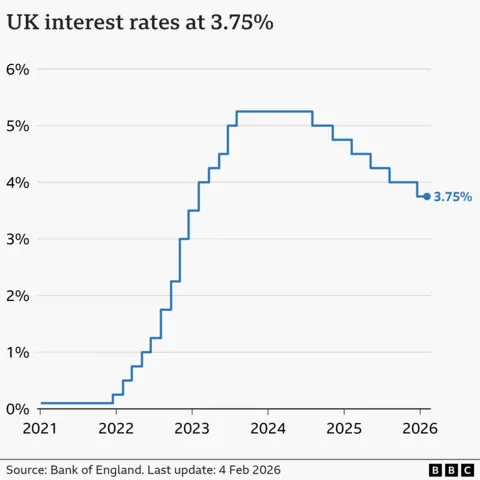

BoE Set to Announce Rate Decision at Noon GMT The Monetary Policy Committee will meet on Thursday, 5 February 2026 and announce its decision at 12:00 GMT. Analysts expect the Bank rate to remain at 3.75%[1]. The decision follows the December cut from 4% to 3.75%[1].

Inflation Remains Above Target, Limiting Further Cuts Annual consumer‑price inflation stood at 3.4%, still above the BoE’s 2% goal[1]. Persistent price pressures and weak growth have left the policy balance unchanged[1]. The committee’s commentary earlier this year signaled a gradual downward path but no immediate further reductions[1].

Mortgage Market Divided Between Fixed and Variable Loans Roughly one‑third of UK households hold a mortgage, with about one million on tracker or variable rates that move with the Bank rate[1]. The majority are on fixed‑rate contracts, whose future pricing could be affected by any policy shift[1]. This split influences household spending and financial stability[1].

Savvy Savers Face Slashed Real Returns Rachel Springall of Moneyfacts warned that more than 70% of savings providers have cut rates since the start of 2026[1]. The decline in savings rates erodes real returns for depositors[1]. The BoE’s rate stance directly impacts the ability of savers to earn positive yields[1].

Monetary Policy Report to Follow Thursday’s Meeting After the decision, the MPC will publish its quarterly Monetary Policy Report, outlining analysis and projections[1]. The report provides insight into the committee’s outlook on inflation, growth, and future rate moves[1]. Stakeholders will scrutinize the document for clues about policy direction[1].

Timeline

Dec 2, 2025 – The Bank of England’s financial‑stability report warns that AI‑related equity valuations are at historic highs comparable to the pre‑dot‑com bubble, cuts the Tier 1 capital buffer for high‑street lenders from 14 % to 13 % (effective 2027), and projects that 3.9 million homeowners will refinance at higher rates by 2028, potentially raising monthly payments up to 8 %[4].

Dec 17‑18, 2025 – The Monetary Policy Committee lowers the Bank rate from 4 % to 3.75 % in a razor‑thin 5‑4 vote; Governor Andrew Bailey, the swing voter, says the UK has passed the peak of inflation and expects the 2 % target to be reached by April 2026, calling the move “encouraging” and signalling a gradual downward path[2][3].

Dec 17‑18, 2025 – Deputy Governor Clare Lombardelli adds that inflation will be driven down by energy‑price cuts and rail‑fare freezes announced in the Budget, notes that inflation slowed to 3.2 % in the year to November and forecasts zero growth in the final months of 2025[3].

Dec 2025 – The December rate cut to 3.75 % establishes the new policy level and frames the BoE’s outlook as a “gradual downward path” for future meetings, marking the first reduction after earlier hikes to 4 %[1].

Early 2026 – Market participants price in roughly two additional BoE rate cuts during 2026, based on the December decision and the expectation that inflation will near the 2 % target by spring‑summer 2026[2].

Feb 5, 2026 – The Monetary Policy Committee is expected to keep the Bank rate unchanged at 3.75 % as annual inflation sits at 3.4 %, still above the 2 % goal, leaving the balance between price pressures and weak growth unchanged[1].

Feb 5, 2026 – Rachel Springall of Moneyfacts warns that “the slaughter of savings rates will sadden hard‑pressed savers,” noting that over 70 % of savings providers have cut rates since the start of the year, leaving real returns weak[1].

Feb 5, 2026 – After the meeting, the BoE will publish its quarterly Monetary Policy Report, outlining its economic analysis and projections for the coming months[1].

2026 – The Bank expects inflation to fall close to the 2 % target by spring or summer, which would underpin the anticipated two further rate cuts later in the year[2][3].

2027 – The reduced Tier 1 capital buffer of 13 % for high‑street lenders takes effect, aiming to support lending and economic growth[4].

2028 – An estimated 3.9 million UK homeowners (about 43 % of mortgage holders) are projected to refinance at higher rates, potentially increasing their monthly mortgage payments by up to 8 % as fixed‑rate deals expire[4].

All related articles (4 articles)

-

BBC: Bank of England likely to keep rates steady at Thursday’s meeting

-

BBC: Bank of England cuts rates with Bailey as swing vote amid festive framing

-

BBC: Bank of England cuts rate to 3.75% as further cuts seen as closer call

-

BBC: Bank of England Signals AI Bubble Risk and Lowers Capital Requirements