India Secures EU and U.S. Free‑Trade Agreements Yet Faces Utilization Challenges

Updated (6 articles)

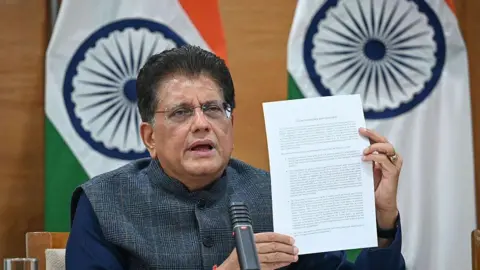

Landmark EU and U.S. FTAs Signed Before March 2026 India concluded free‑trade agreements with the European Union and the United States before March 2026, branding them the “mother” and “father” of its trade deals [1]. The accords represent the country’s tenth FTA since 2014, marking a decisive shift away from the protectionist stance that dominated earlier negotiations [1]. Officials highlight the strategic pivot toward deeper market integration across Western economies [1].

Early Trade Impact Shows Imbalanced Growth Export volumes to FTA partners rose 31 % between 2017 and 2022, while imports surged 82 % in the same period, indicating a pronounced trade imbalance despite tariff reductions [1]. Utilisation of the agreements remains low, with only about 25 % of their potential being tapped compared with 70‑80 % in developed economies [1]. Analysts warn that the limited uptake curtails the intended economic gains of the treaties [1].

Operational Barriers Threaten Full Benefit Realization Self‑certified Rules of Origin, high documentation costs, and lingering non‑tariff barriers are identified as major obstacles to leveraging the new pacts [1]. Experts Kiran Kotla, Ajay Srivastava, and Priyanka Kishore stress that efficiency in implementation, rather than tariff cuts alone, will determine the deals’ success [1]. Vietnam’s rapid customs procedures are cited as a benchmark for competitiveness [1].

India Expands Outreach With GCC Negotiations Parallel to the EU‑U.S. deals, India launched negotiations with the Gulf Cooperation Council, a bloc accounting for roughly 15 % of its global trade [1]. The six‑nation talks aim to broaden market access and diversify export destinations [1]. Early engagement signals a broader strategy to embed India deeper into global supply chains [1].

Timeline

2007 – The European Union and India launch free‑trade negotiations, beginning a protracted dialogue that stalls for years before being revived in 2022 [3].

July 2022 – The EU and India revive the stalled FTA talks, re‑opening negotiations that had been dormant since the early 2010s [3].

2014‑2025 – India signs its tenth free‑trade agreement since 2014, marking a strategic shift away from earlier protectionist policies and expanding its global trade network [1].

2023 – The EU withdraws Generalised System of Preferences (GSP) benefits for India, raising tariffs on Indian garments, pharmaceuticals, steel and other products and prompting Delhi to seek new market‑access arrangements [4].

2024 – The EU becomes India’s top goods partner, with bilateral trade reaching $142.3 bn, accounting for 11.5 % of India’s total trade and underscoring the economic importance of a future pact [2].

2025 – The United States imposes a 50 % tariff on Indian imports and adds a 25 % levy for purchasing discounted Russian oil, intensifying pressure on Delhi to diversify its export markets and contributing to the collapse of a proposed India‑US trade deal [2][5][6].

Early 2026 – The EU finalises its long‑awaited Mercosur agreement, signalling a broader European push for new trade blocs and creating a favourable backdrop for the India‑EU negotiations [2][5].

Jan 24, 2026 – European Council President Antonio Luis Santos da Costa and Commission President Ursula von der Leyen attend India’s Republic Day celebrations and use the event to accelerate the pending “mother of all deals” trade pact, while also pledging to restore EU GSP benefits withdrawn in 2023 [4].

Jan 27, 2026 – Prime Minister Narendra Modi and EU leaders announce that the EU‑India free‑trade agreement, concluding nearly two decades of talks that began in 2007, will create a tariff‑free zone covering 25 % of global GDP and a market of two billion people, with duties on cars falling from 110 % to 10 % under a 250,000‑vehicle quota [3][5][6].

Jan 27, 2026 – Both Modi and von der Leyen label the pact the “mother of all deals,” emphasizing its scale and strategic intent to provide a stable commercial corridor and reduce reliance on the United States amid 50 % US tariffs on Indian goods [5][6].

Jan 27, 2026 – The agreement excludes sensitive Indian agricultural products such as dairy and sugar, while promising steep tariff cuts on EU chemicals, machinery, aircraft and cars, and sets a target to lift bilateral trade from $136.5 bn in FY 2024‑25 to $200 bn by 2030 [5][6].

Jan 27, 2026 – US Treasury Secretary Scott Bessent warns that the EU‑India deal could indirectly finance Russia’s war through India’s purchase of Russian crude, a claim Delhi rejects, insisting the oil purchase secures energy for millions [2].

Jan 27, 2026 – Experts highlight that self‑certified Rules of Origin, high documentation costs and the EU Carbon Border Adjustment Mechanism could blunt the pact’s benefits, urging operational efficiency over tariff reductions [1][4].

Feb 18, 2026 – India finalises FTAs with both the EU and the United States, launches Gulf Cooperation Council (GCC) talks that cover 15 % of its global trade, while analysts note that only about 25 % of FTA potential is currently utilised compared with 70‑80 % in developed economies [1].

Mid‑2026 (expected) – After a five‑to‑six‑month legal vetting period, India and the EU plan to formally sign the agreement, followed by ratification by the European Parliament and Council later in the year, paving the way for implementation within a year [5].

2030 (target) – Indian officials aim to raise EU‑India bilateral trade to roughly $200 bn, leveraging the new tariff reductions and expanded market access to drive growth in labor‑intensive sectors [6].

All related articles (6 articles)

-

BBC: India clinches EU and US trade pacts, but utilisation and rules pose hurdles

-

BBC: India‑EU Trade Deal Gains Momentum Amid Trump‑Era Tariff Pressures

-

CNN: India and EU Finalize Landmark Trade Pact, Await Formal Signing

-

BBC: EU and India seal landmark free‑trade pact amid US tariff pressures

-

AP: India and EU Finalize Free Trade Deal Amid US Tariff Pressures

-

BBC: India‑EU Trade Talks Intensify Ahead of Republic Day Summit

External resources (9 links)

- https://www.youtube.com/@bbcnewsindia/featured (cited 4 times)

- https://www.reuters.com/world/india/eu-nears-historic-trade-deal-with-india-von-der-leyen-says-2026-01-20/ (cited 1 times)

- https://www.facebook.com/bbcindia/ (cited 4 times)

- https://www.instagram.com/bbcnewsindia/ (cited 4 times)

- https://x.com/BBCIndia (cited 4 times)

- http://xn--cross%20the%20eus%2027%20nations%20i-yl8v/ (cited 1 times)

- https://eastasiaforum.org/2023/09/19/what-went-wrong-with-indias-ftas/ (cited 1 times)

- https://www.hindustantimes.com/india-news/india-eu-trade-pact-to-be-very-important-geopolitical-stabiliser-antonio-costa-101769440061733.html (cited 1 times)