Supreme Court Blocks Trump Tariffs, India Reviews Deal Amid New 10% Surcharge

Updated (49 articles)

Supreme Court Declares Global Tariffs Unlawful On February 20 2026 the U.S. Supreme Court issued a 6‑3 ruling, authored by Chief Justice John Roberts, that President Donald Trump exceeded his authority under the International Emergency Economic Powers Act when imposing worldwide tariffs, nullifying the levies on the United Kingdom, Japan, the EU, Malaysia, Indonesia, Vietnam and India [1][2][3][4][5][6]. The decision emphasizes that only Congress may impose taxes, a point highlighted by the Court’s majority opinion [6]. International leaders such as French President Emmanuel Macron praised the judgment as a check on executive power [1].

Trump Announces 10% Temporary Import Surcharge Minutes after the ruling, Trump proclaimed a “temporary import surcharge of 10 % ad valorem” on all goods entering the United States, to take effect on February 24 2026 for a period of 150 days, invoking Section 122 of the Trade Act as a legal workaround [1][2][3][4][6]. Treasury Secretary Scott Bessent suggested the surcharge could be applied “in a less direct and slightly more convoluted manner,” hinting at indirect tariff routes [4]. Trump framed the measure as a response to the Court’s decision and reiterated that the February 2 India‑U.S. trade agreement remains unchanged [6].

Interim India‑U.S. Trade Pact Holds at 18 % Tariff The February 2 interim agreement, signed by Trump and Prime Minister Narendra Modi, reduces the reciprocal tariff on Indian goods from 25 % to 18 % and leaves the United States without reciprocal duties [5][6][7]. Negotiators are scheduled to meet in Washington from February 23‑25 to finalize the pact, with a formal signing expected in March and implementation slated for April [2][7]. Despite the Court’s ruling, Section 232 tariffs on steel and aluminium (50 %) and existing Section 301 measures remain in force [3][4].

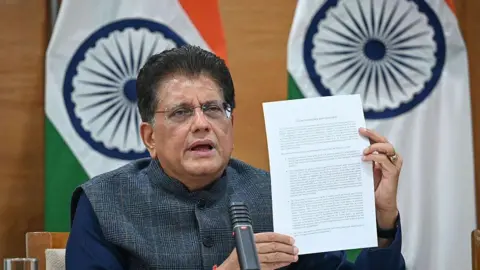

Indian Government Monitors Fallout While Opposition Calls Pause India’s Ministry of Commerce & Industry announced on February 21 that it is reviewing the Supreme Court judgment and Trump’s surcharge for potential impacts on the interim deal and domestic exporters [1][2]. Opposition figures Jairam Ramesh and Rahul Gandhi publicly urged Prime Minister Modi to suspend the agreement, arguing it harms farmers and compromises sovereignty [1][5]. Commerce Minister Piyush Goyal defended the pact, citing projected $500 billion U.S. imports and sectoral gains in apparel, leather and marine exports [7].

Market Reactions and Trade Data Highlight Strain Economists at the Penn‑Wharton Budget Model estimate up to $175 billion in tariff collections could be refundable, and U.S. stock indices rose modestly after the Court’s decision [1]. Indian steel and aluminium shipments to the United States plunged 66 % in December 2025, reflecting the earlier 25 % punitive duties before the partial rollback [3]. The suspension of the de‑minimis exemption for shipments under $800 continues to pressure small Indian exporters and e‑commerce firms [3].

Sources

-

1.

The Hindu: U.S. Supreme Court blocks Trump’s global tariffs; India and allies react: reports the 6‑3 Court decision, Trump’s 10 % surcharge, Indian ministry review, opposition criticism, and global market impact .

-

2.

The Hindu: India’s Commerce Ministry reviews U.S. tariff fallout after Supreme Court ruling: details the ministry’s monitoring, the 10 % surcharge atop existing MFN duties, and upcoming trade talks .

-

3.

The Hindu: U.S. Tariff Landscape Shifts After Supreme Court Ruling: notes the nullification of reciprocal tariffs, continuation of 50 % steel/aluminium duties, and a 66 % drop in Indian metal exports .

-

4.

The Hindu: Trump Mulls New Tariff Routes After Supreme Court Ruling: describes Trump’s intent to use Section 122 for a global tariff and Treasury hints at indirect applications .

-

5.

The Hindu: Congress Accuses Modi of Compromise as US Court Dismantles Trump Tariffs: highlights Rahul Gandhi’s and Jairam Ramesh’s accusations against Modi and Trump’s claim of a “fair” deal .

-

6.

The Hindu: Trump says U.S.–India trade deal unchanged after Supreme Court strikes tariffs: records Trump’s assertion that the interim pact stays intact and his plan for a 10 % global tariff .

-

7.

The Hindu: India‑U.S. Interim Trade Pact Set for April Implementation, Says Commerce Minister: outlines the signing timeline, tariff reduction to 18 %, and related FTAs with the UK, Oman and New Zealand .

-

8.

BBC: India Secures Landmark EU and US Trade Deals Amid Implementation Hurdles: provides context on India’s broader FTA strategy, low utilisation rates, and operational challenges facing exporters .

Related Tickers

Timeline

2014 – India signs its first of ten free‑trade agreements (FTAs) since 2014, beginning a shift from a protectionist stance toward broader market openness [1].

July 2022 – The European Union revives stalled India‑EU trade talks that originally began in 2007, setting the stage for a deal after nearly two decades [4].

2023 – The EU withdraws India’s Generalised System of Preferences (GSP), eroding tariff advantages on garments, pharmaceuticals, steel and other sectors and prompting India to seek new market access [5].

July 30, 2025 – President Donald Trump imposes a 25 % tariff on Indian imports, linking it to India’s purchases of Russian oil and marking the first major U.S. trade penalty on India [30].

August 27, 2025 – Trump expands the tariff on Indian goods to 50 % via an executive order, intensifying pressure on India’s export‑oriented sectors [30].

November 21, 2025 – India notifies its four Labour Codes, consolidating 13 central labour laws and preparing for full implementation on 1 April 2026, a reform that will affect trade‑related employment standards [30].

December 16, 2025 – India’s Lok Sabha passes a bill raising the foreign‑direct‑investment cap in the insurance sector to 100 %, signalling a push for greater foreign capital in a strategic industry [30].

December 25, 2025 – The United States advances the “Russia Sanctions Act,” a bipartisan bill that would allow tariffs of up to 500 % on secondary buyers of Russian oil, and announces a withdrawal from the India‑led International Solar Alliance, heightening diplomatic pressure on New Delhi [25].

January 1, 2026 – The EU’s Carbon Border Adjustment Mechanism (CBAM) begins taxing Indian steel and aluminium exports, a non‑tariff barrier that Congress says must be addressed in the pending India‑EU FTA [28].

January 5, 2026 – President Trump claims U.S. tariff receipts will exceed $600 billion and praises the tariffs as a boost to national security, while also asserting that India cut Russian oil purchases to win his favour [26, 27].

January 8, 2026 – Trump backs the 500 % tariff bill on Russian‑oil buyers and formally withdraws the United States from the International Solar Alliance, underscoring a hardening U.S. stance toward India’s energy ties [25].

January 9, 2026 – India and the EU hold two‑day FTA talks in Brussels, reaffirming a rules‑based framework that protects farmers and MSMEs and noting that 16 negotiation rounds have taken place [22, 23]; the same day, MEA rebuts claims that Modi failed to call Trump, citing eight 2025 conversations [21]; meanwhile, lobbyist Lutnick blames Modi’s reluctance to call Trump for the stalled U.S.‑India deal [24].

January 12, 2026 – U.S. Ambassador Sergio Gor tells reporters that India‑U.S. trade negotiations remain active and that a follow‑up call is scheduled, while noting ongoing U.S. demands for greater access to Indian agriculture [20].

January 24, 2026 – Ahead of India’s Republic Day, EU leaders (President Antonio Santos da Costa and Commission President Ursula von der Leyen) attend the celebrations and push the pending “mother of all deals” India‑EU FTA, while stressing the need to restore EU GSP benefits and resolve the EU carbon tax issue [5].

January 26, 2026 – EU heads attend India’s Republic Day summit, using the high‑profile event to accelerate final‑stage EU‑India trade negotiations [5].

January 27, 2026 – India and the EU announce a landmark “mother of all deals” free‑trade agreement covering 25 % of global GDP and a two‑billion‑person market; the pact awaits EU Parliament ratification later in 2026 and promises deep tariff cuts on chemicals, machinery, aircraft and cars, though agriculture and dairy remain excluded [4, 19]; simultaneously, India‑EU talks gain momentum amid U.S. tariff pressures, with leaders branding the pact strategic and warning that the EU carbon border tax could hinder implementation [3].

February 2, 2026 – President Trump announces a U.S.–India trade deal that lowers U.S. tariffs on Indian goods from 25 % (or 50 % with the Russian‑oil penalty) to 18 % and eliminates the 25 % penalty for Russian‑oil imports; Trump also says India will cease buying Russian oil and will purchase $500 billion of U.S. goods over five years [2, 9, 13, 14, 15, 17, 18].

February 3, 2026 – India’s Commerce Minister Piyush Goyal confirms that the interim U.S.–India pact will be signed in March and become operational in April, while also noting pending UK and Oman FTAs for April and a New Zealand pact for September [10]; Congress demands a parliamentary debate on the U.S. and EU trade texts, accusing Modi of surrendering to Trump and warning of agricultural liberalisation risks [16]; the United States formally cuts tariffs on Indian goods to 18 % but leaves many details of the broader agreement undisclosed, prompting industry praise for tariff relief and criticism over excluded agri‑dairy items [13, 14, 15, 17, 18].

February 4, 2026 – White House Press Secretary Karoline Leavitt announces that India will stop purchasing Russian oil, shift to U.S. supplies, and commit $500 billion to U.S. investment across transport, energy and agriculture [11]; the same day, External Affairs Minister S. Jaishankar and U.S. Secretary of State Antony Rubio meet in Washington to cement the trade deal and launch formal critical‑minerals cooperation ahead of a U.S.‑led ministerial [12].

February 18, 2026 – India finalises landmark FTAs with both the EU and the United States, marking its tenth FTA since 2014 and signalling a decisive pivot away from protectionism; the government also announces the start of Gulf Cooperation Council (GCC) negotiations covering 15 % of India’s trade [1].

February 20, 2026 – Commerce Minister Goyal says the India‑U.S. interim trade agreement will be signed in March and take effect in April, while also confirming that the U.S. tariff on Indian goods falls to 18 % after the earlier Russian‑oil penalty is removed [10]; on the same day, the U.S. Supreme Court issues a 6‑3 ruling that blocks Trump’s global tariffs as exceeding IEPA authority, prompting Trump to impose a 10 % “temporary import surcharge” for 150 days as a workaround [6]; the Court’s decision fuels Indian opposition calls to pause the interim pact [8, 16].

February 21, 2026 – The Supreme Court’s blockage of Trump’s emergency‑powers tariffs triggers India’s Commerce Ministry to review the implications for the interim U.S. deal, while Congress leaders label Modi “compromised” and demand a hold on the pact [8, 6]; Trump announces plans to use the rarely‑used Section 122 of the Trade Act to impose a 10 % global tariff “in a less direct” manner, signalling a new tariff route after the Court’s ruling [7]; Trump also reiterates that the February 2 trade agreement remains unchanged despite the Court’s decision [9].

Dive deeper (11 sub-stories)

-

Supreme Court Nullifies Trump’s Global Tariffs, Prompting 10% Surcharge and Indian Review

(21 articles)

-

India‑U.S. Interim Trade Pact to Be Signed March, Activate April, Says Minister

(4 articles)

-

India Secures EU and U.S. Free‑Trade Agreements Yet Faces Utilization Challenges

(6 articles)

-

India‑U.S. Trade Deal Advances Amid Farmer Protest Threats and Parliamentary Turmoil

(3 articles)

-

The Hindu: Opposition MPs Press Government Over India‑U.S. Trade Deal Impact on Farmers

-

Congress Calls for Parliamentary Debate as US Lowers Tariffs and EU Pact Finalized

(4 articles)

-

US Ambassador Gor Confirms Ongoing India‑US Trade Talks, Next Call Set for Tuesday

(3 articles)

-

Goyal’s Brussels Mission Boosts Momentum Toward Early India‑EU Free Trade Deal

(3 articles)

-

Trump Supports 500% Tariffs, Withdraws from Solar Alliance, Envoy Arrives in Delhi

(2 articles)

-

The Hindu: Trump says India cut Russian oil to please him; Graham backs ambassador claim

-

The Hindu: EU carbon border tax hits Indian exports to EU, says Jairam Ramesh

All related articles (49 articles)

-

The Hindu: U.S. Supreme Court blocks Trump’s global tariffs; India and allies react

-

The Hindu: India’s Commerce Ministry reviews U.S. tariff fallout after Supreme Court ruling

-

The Hindu: U.S. Tariff Landscape Shifts After Supreme Court Ruling

-

The Hindu: Trump Mulls New Tariff Routes After Supreme Court Ruling

-

The Hindu: Congress Accuses Modi of Compromise as US Court Dismantles Trump Tariffs

-

The Hindu: Trump says U.S.–India trade deal unchanged after Supreme Court strikes tariffs

-

The Hindu: India‑U.S. Interim Trade Pact Set for April Implementation, Says Commerce Minister

-

BBC: India Secures Landmark EU and US Trade Deals Amid Implementation Hurdles

-

The Hindu: India‑US Trade Deal Promises Tariff Cuts and $500 Billion Imports

-

The Hindu: India and U.S. Near Trade Deal: Joint Statement Expected in Days, Legal Agreement by Mid‑March

-

The Hindu: Congress Leader Kharge Warns of Farmer Protests Over India‑U.S. Trade Deal

-

The Hindu: India‑U.S. Trade Deal Protects Agriculture, Cuts Dairy Tariffs, Sparks Parliamentary Row

-

The Hindu: India’s Sharad Pawar Flags Farmer Concerns Over New U.S. Tariff Policy

-

The Hindu: India to End Russian Oil Purchases and Commit $500 Billion to U.S. Investment, Trump Announces

-

The Hindu: India‑U.S. Talks Advance Trade Deal and Critical Minerals Cooperation

-

The Hindu: India‑U.S. Trade Deal Relieves Exporters, Sparks Farmer Opposition

-

The Hindu: India‑US Trade Deal Cuts Tariffs, Yet Details Remain Unclear

-

The Hindu: Opposition MPs Press Government Over India‑U.S. Trade Deal Impact on Farmers

-

The Hindu: India‑U.S. Trade Deal Excludes Agriculture, Lowers U.S. Tariffs, and Promises Broad Export Gains

-

Newsweek: Trump Announces Surprise US‑India Trade Deal Reducing Tariffs to 18%

-

The Hindu: India‑U.S. Trade Deal Cuts Tariffs to 18%, Sparks Market Rally and Industry Praise

-

The Hindu: Congress Demands Parliament Review of India‑US and EU Trade Deals

-

The Hindu: U.S. Cuts Tariffs on Indian Goods to 18% Amid Unresolved Trade Deal Details

-

The Hindu: India‑U.S. Trade Deal Lowers Indian Tariffs to 18% Amid Praise and Criticism

-

AP: Trump Announces 18% Tariff Cut for India After Russian Oil Deal

-

BBC: US‑India Trade Deal Cuts Tariffs to 18% After India Halts Russian Oil Purchases

-

The Hindu: Modi and Trump announce 18% U.S. tariff on “Made in India” goods

-

BBC: India‑EU Trade Deal Gains Momentum Amid Trump‑Era Tariff Pressures

-

CNN: India and EU Finalize Landmark Trade Pact, Await Formal Signing

-

BBC: EU and India seal landmark free‑trade pact amid US tariff pressures

-

AP: India and EU Finalize Free Trade Deal Amid US Tariff Pressures

-

BBC: India‑EU Trade Talks Intensify Ahead of Republic Day Summit

-

BBC: US ambassador says India-US trade talks continue amid tariff tensions

-

The Hindu: Goyal wraps Brussels trip, upbeat on early conclusion of India-EU FTA ahead of summit

-

The Hindu: MEA reaffirms balanced trade pact with US as Taliban diplomat arrives in Delhi and other developments

-

The Hindu: U.S. ambassador-designate Gor arrives in India, cites opportunities ahead

-

The Hindu: MEA rebuts Lutnick claim, says Modi-Trump spoke eight times in 2025 as trade talks persist

-

BBC: India denies Lutnick claim that Modi didn't call Trump as US-India trade talks stall

-

The Hindu: India–EU hold FTA talks in Brussels, reaffirm safeguards for farmers and MSMEs

-

The Hindu: India and EU hold Brussels FTA talks to protect farmers and MSMEs

-

The Hindu: Lutnick says Modi didn't call Trump, derailing India-U.S. trade deal

-

The Hindu: Trump's tariff and withdrawal moves heighten energy and diplomatic pressure on India as domestic and global stories unfold

-

The Hindu: Trump backs bill for up to 500% tariffs on Russian oil buyers and pulls U.S. from India-led International Solar Alliance

-

The Hindu: Trump says PM Modi is “not that happy” over US tariffs, cites cuts to Russian oil and Apache deliveries

-

The Hindu: Trump says U.S. tariff receipts will top $600B, touts national strength

-

The Hindu: Trump says India cut Russian oil to please him; Graham backs ambassador claim

-

The Hindu: EU carbon border tax hits Indian exports to EU, says Jairam Ramesh

-

The Hindu: India enters 2025 with high diplomatic expectations, then faces U.S. tariffs and regional strain

-

The Hindu: Tariffs, reforms, and EV entries shape India's 2025 business year

External resources (15 links)

- https://www.youtube.com/@bbcnewsindia/featured (cited 5 times)

- https://www.mea.gov.in/Speeches-Statements.htm?dtl%2F39945%2FStatement_by_Official_Spokesperson (cited 1 times)

- https://www.pib.gov.in/PressNoteDetails.aspx?id=157070&NoteId=157070&ModuleId=3®=3&lang=2#:~:text=Bilateral%20trade%20volume%20reached%20approximately,increasing%20to%20%E2%82%AC29%20billion. (cited 1 times)

- https://www.whitehouse.gov/fact-sheets/2026/02/fact-sheet-the-united-states-and-india-announce-historic-trade-deal/ (cited 1 times)

- https://www.reuters.com/world/china/indias-exports-defy-tariffs-strengthen-hand-us-trade-talks-2025-12-16/ (cited 1 times)

- https://www.reuters.com/world/india/eu-nears-historic-trade-deal-with-india-von-der-leyen-says-2026-01-20/ (cited 1 times)

- https://www.facebook.com/bbcindia/ (cited 5 times)

- https://www.instagram.com/bbcnewsindia/ (cited 5 times)

- https://x.com/BBCIndia (cited 5 times)

- https://t.co/gPz6rWtrxj (cited 1 times)

- https://t.co/hA1zbnt3JQ (cited 1 times)

- https://twitter.com/janusmyth?ref_src=twsrc%5Etfw (cited 1 times)

- http://xn--cross%20the%20eus%2027%20nations%20i-yl8v/ (cited 1 times)

- https://eastasiaforum.org/2023/09/19/what-went-wrong-with-indias-ftas/ (cited 1 times)

- https://www.hindustantimes.com/india-news/india-eu-trade-pact-to-be-very-important-geopolitical-stabiliser-antonio-costa-101769440061733.html (cited 1 times)